Open the Benefits of Engaging Debt Expert Provider to Browse Your Course Towards Financial Debt Relief and Financial Liberty

Engaging the solutions of a financial obligation expert can be a critical step in your trip in the direction of accomplishing financial debt alleviation and economic stability. These professionals offer tailored methods that not just analyze your distinct financial conditions but additionally supply the essential guidance needed to browse complex negotiations with creditors. Comprehending the complex advantages of such experience might expose options you had not previously taken into consideration. Yet, the question stays: what specific benefits can a financial debt professional give your monetary scenario, and how can you recognize the ideal companion in this endeavor?

Recognizing Debt Expert Provider

Financial debt consultant solutions provide specialized support for individuals grappling with monetary obstacles. By analyzing your income, debts, and expenses, a debt professional can assist you recognize the origin causes of your financial distress, allowing for a more accurate approach to resolution.

Financial debt consultants commonly use a multi-faceted method, which may consist of budgeting help, settlement with lenders, and the advancement of a tactical payment strategy. They serve as intermediaries in between you and your creditors, leveraging their know-how to discuss much more favorable terms, such as reduced passion rates or prolonged settlement timelines.

Additionally, financial debt specialists are geared up with current expertise of pertinent legislations and regulations, guaranteeing that you are educated of your civil liberties and alternatives. This expert guidance not just reduces the psychological burden connected with financial obligation however also equips you with the devices needed to restore control of your financial future. Ultimately, involving with financial debt specialist services can bring about a much more organized and enlightened course towards financial stability.

Secret Benefits of Specialist Guidance

Engaging with financial obligation consultant services presents many benefits that can substantially boost your economic circumstance. One of the key benefits is the expertise that specialists offer the table. Their considerable expertise of financial obligation management techniques allows them to tailor services that fit your one-of-a-kind conditions, guaranteeing a much more efficient method to accomplishing financial stability.

In addition, financial debt professionals often supply arrangement support with lenders. Their experience can result in much more favorable terms, such as minimized rates of interest or settled financial obligations, which might not be attainable with straight settlement. This can cause considerable monetary relief.

Additionally, consultants supply a structured prepare for payment, helping you focus on financial debts and allocate sources efficiently. This not just simplifies the repayment procedure but likewise fosters a sense of accountability and development.

Eventually, the mix of expert advice, arrangement abilities, structured repayment strategies, and emotional support settings debt specialists as important allies in the pursuit of financial obligation alleviation and monetary freedom.

Exactly How to Choose the Right Professional

When choosing the best financial obligation expert, what essential factors should you consider to ensure a positive outcome? Initially, assess the consultant's qualifications and experience. debt consultant services singapore. Try to find certifications from recognized organizations, as these indicate a degree of professionalism and knowledge in financial obligation monitoring

Following, consider the specialist's reputation. Research on-line evaluations, reviews, and rankings to gauge previous customers' fulfillment. A strong performance history of effective debt resolution is necessary.

In addition, examine the professional's approach to financial debt monitoring. An excellent consultant needs to offer tailored services customized to your one-of-a-kind financial situation rather than a one-size-fits-all service - debt consultant services singapore. Openness in their processes and fees is critical; ensure you comprehend the costs entailed before committing

Communication is another key element. Choose a consultant that is friendly and ready to address your concerns, as a solid working connection can enhance your experience.

Typical Debt Alleviation Methods

While different financial debt relief approaches exist, choosing the best one depends on private economic scenarios and goals. Some of one of the most usual methods consist of financial debt consolidation, debt management plans, and financial debt settlement.

Debt debt consolidation includes incorporating multiple financial debts right into a solitary lending with a reduced rate of interest. This approach streamlines repayments and can lower regular monthly obligations, making it much easier for people to reclaim control of their finances.

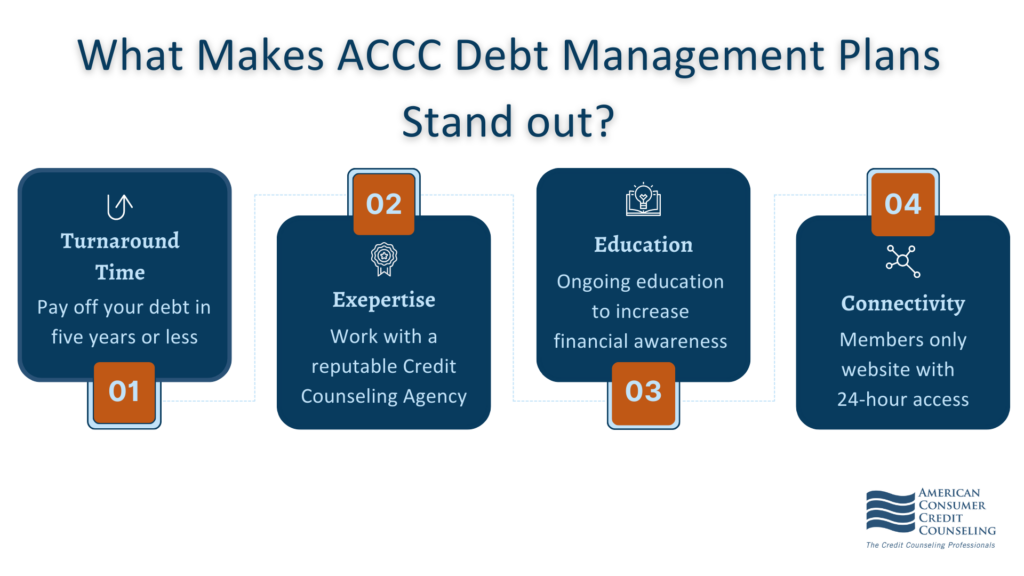

Financial debt management strategies (DMPs) are made by debt therapy companies. They bargain with lenders to lower rate of interest and create a structured layaway plan. This alternative enables individuals to pay off debts over a fixed duration while gaining from specialist advice.

Financial obligation negotiation entails discussing directly with financial institutions to settle financial debts for less than the overall quantity owed. While this method can give prompt relief, it might affect credit score scores and often includes a lump-sum payment.

Lastly, bankruptcy is a lawful alternative that can provide relief from overwhelming financial obligations. Nonetheless, it has lasting financial ramifications and need to be thought about as a last hotel.

Picking the suitable strategy requires careful assessment of one's economic situation, making certain a tailored technique to accomplishing you could check here lasting security.

Steps Towards Financial Flexibility

Next, establish a practical budget that prioritizes essentials and promotes financial savings. This budget must consist of stipulations for debt repayment, allowing you to allot surplus funds properly. Complying with a budget plan aids cultivate regimented investing routines.

When a budget plan remains in location, more information think about engaging a debt expert. These experts supply tailored methods for handling and reducing financial obligation, offering understandings that can accelerate your journey toward economic liberty. They may suggest options such as debt combination or arrangement with lenders.

In addition, focus on constructing an emergency situation fund, which can stop future economic stress and offer tranquility of mind. With each other, these steps create a structured strategy to achieving financial liberty, changing goals right into reality.

Final Thought

Engaging financial debt professional services supplies a calculated approach to accomplishing debt relief and financial flexibility. Ultimately, the knowledge of financial debt consultants substantially enhances the chance of navigating the intricacies of financial obligation management properly, leading to a much more protected monetary future.

Involving the services of a financial obligation professional can be an essential step in your trip towards achieving debt alleviation and financial stability. Financial obligation specialist services supply specialized support for people grappling with financial difficulties. By analyzing your revenue, financial debts, and expenditures, a financial obligation consultant can aid you determine the origin creates of your financial distress, enabling for a much more accurate method to resolution.

Engaging financial obligation consultant solutions provides a critical method to attaining debt relief and economic flexibility. Eventually, the expertise of financial debt specialists see post dramatically enhances the likelihood of navigating the intricacies of financial debt administration successfully, leading to an extra secure monetary future.